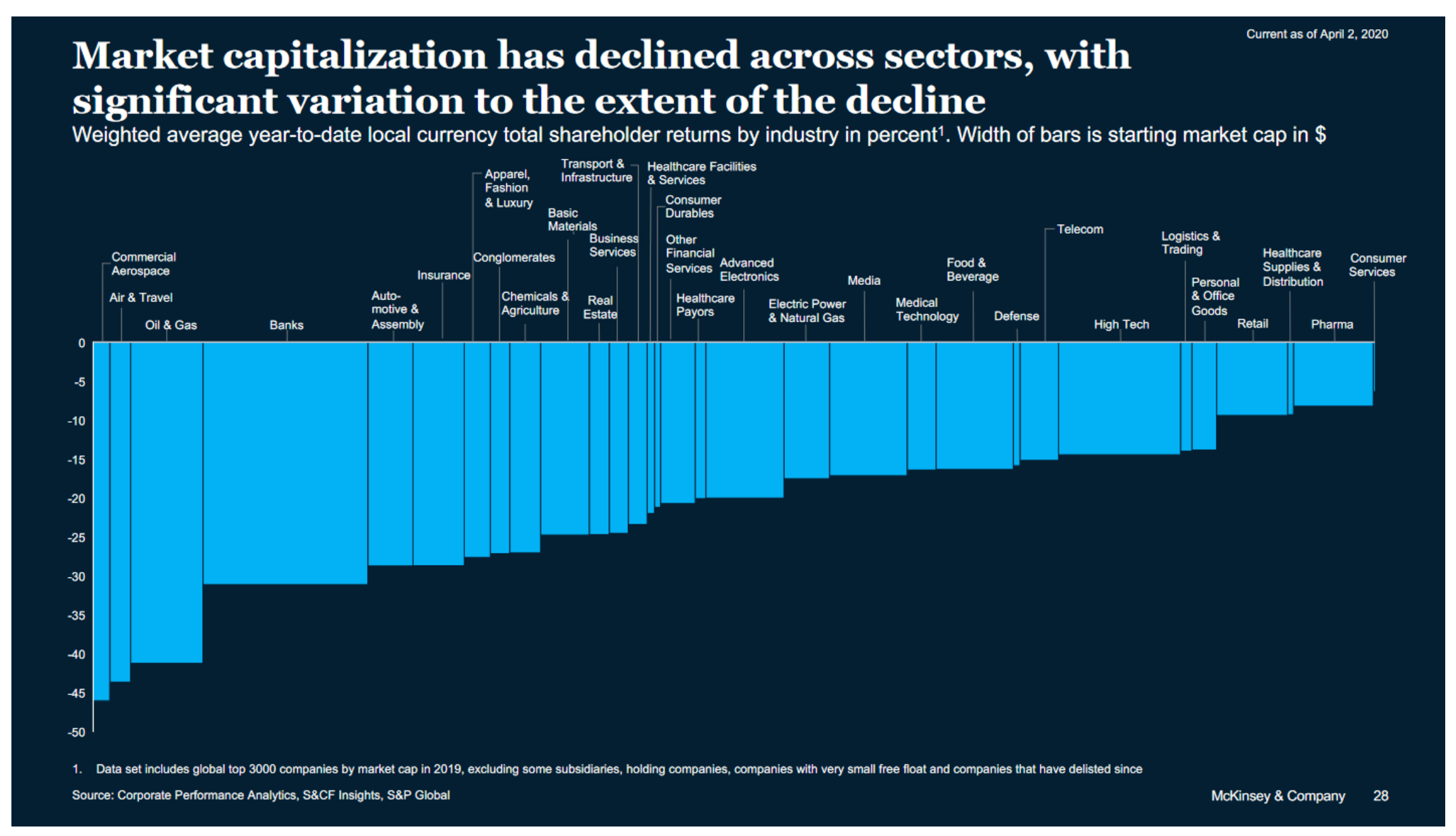

The market capitalisation declines induced by COVID-19 in the ‘Air & Travel’ and ‘Commercial Aerospace’ sectors have been profound.

Source: McKinsey & Co. ‘COVID-19: Briefing materials. Global health and crisis response’ dated April 4th 2020

About one month ago, my personal ‘worst-case scenario’ outlook would have seen Australian hotel occupancies dropping by around 80% (to around 5-10% occ), for a period of about 3 months, with a slow recovery thereafter. This scenario would likely see 80% or more of a city’s hotels temporarily close or enter care-taker mode. This exact scenario was already playing out in other global cities, mostly in China, Italy and Spain. Government lockdowns induced these conditions.

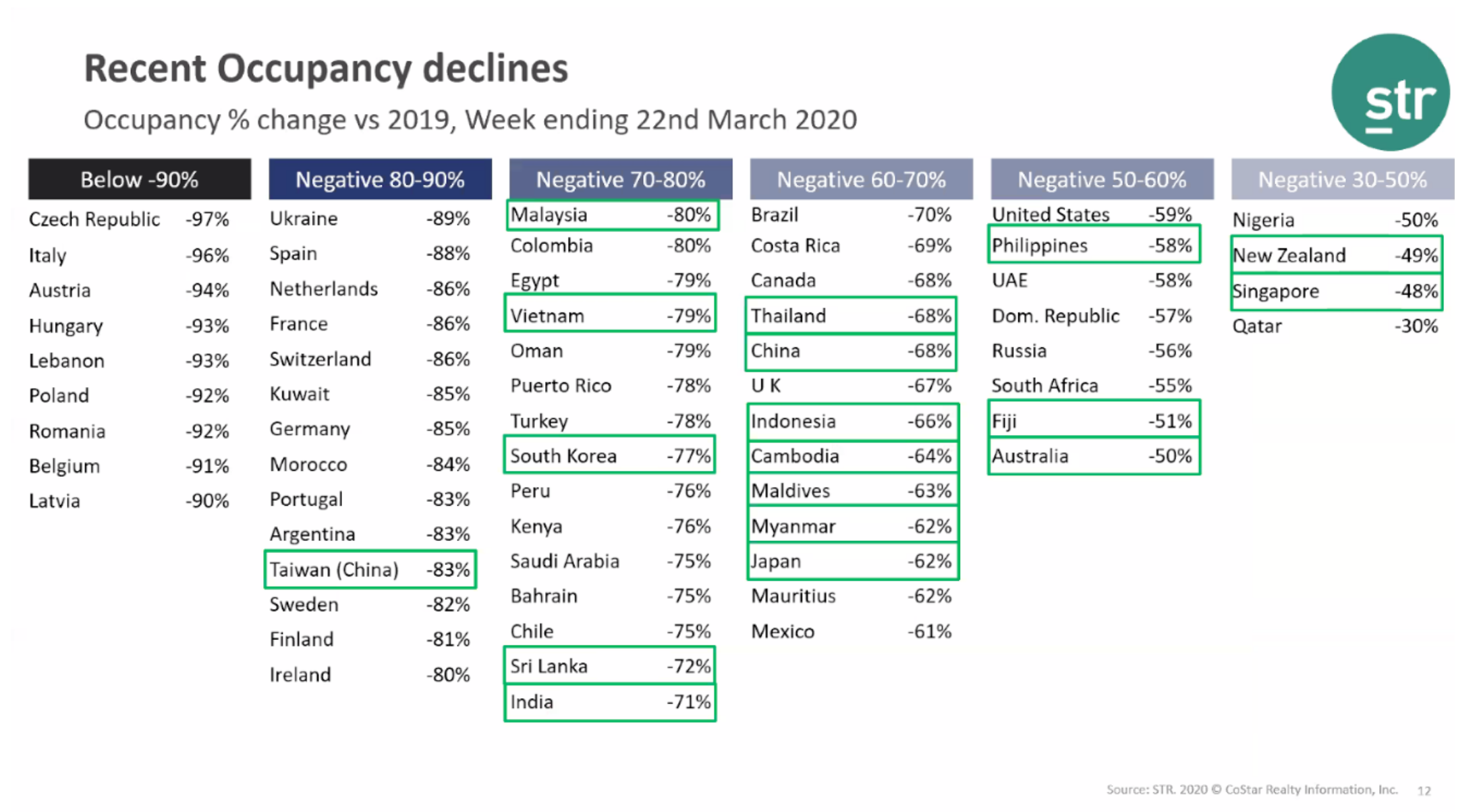

Sample of hotel occupancy declines seen week ending 22nd March 2020:

At the time, the Australian government had only travel advisories in place, so this scenario was a possibility, but not a guarantee. Hotel occupancies had already begun falling – but I was expecting them to bottom-out at around 10-20%.

Since mid-March, the Federal and State governments have implemented orders that now supress almost all hotel demand for the near-term. The strongest of these Orders for VIC and NSW was dated 30th March 2020, ruling that a person must not, without reasonable excuse, leave the person’s place of residence – essentially outlawing leisure travel anywhere in the states. The equivalent order was passed in QLD on the 9th April 2020. Since implementing these laws, hotel occupancies have fallen to 0-5% Australia- wide. This statistic has been verified across multiple major chain operators.

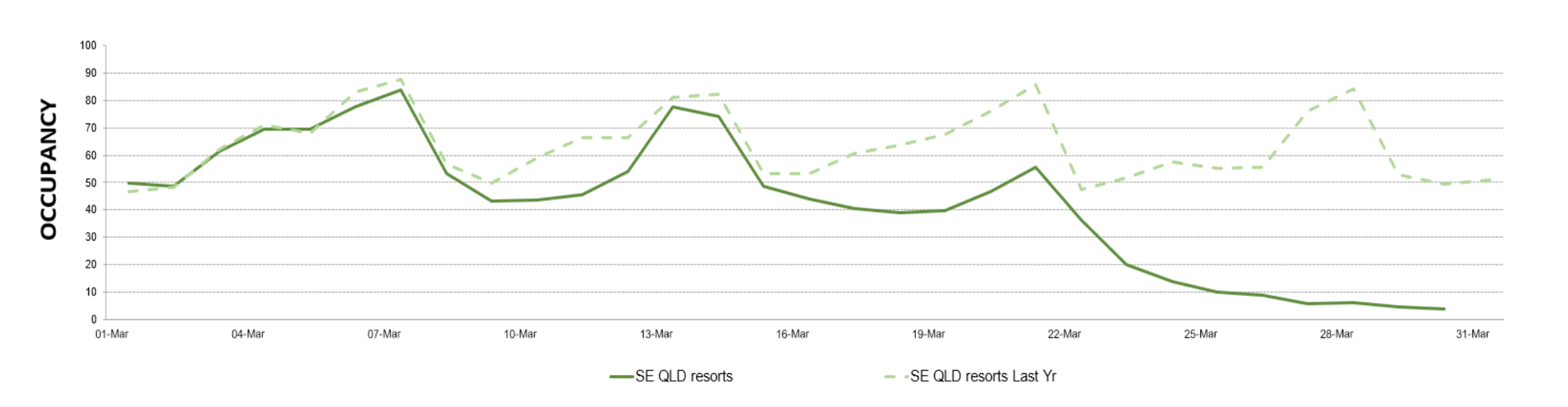

The below graph shows the year-over-year deterioration in daily occupancies throughout March for a sample of larger SE Qld resorts. All have been sitting at 0-3% daily occupancy since 1st April 2020.

By early April, most existing bookings for April and May had been cancelled, and bookings for travel dates thereafter grinded to an absolute halt. All hotel websites and reservation phones went silent. We are officially at the demand bottom, with most Australian hotels running at 0-5% occupancy, not receiving any future bookings, and have likely entered care-taker mode. Almost the entire operational component of the accommodation industry workforce has been stood down or let go. A small handful of hotels have captured government sponsored isolation groups; however, this demand will soon dry up.

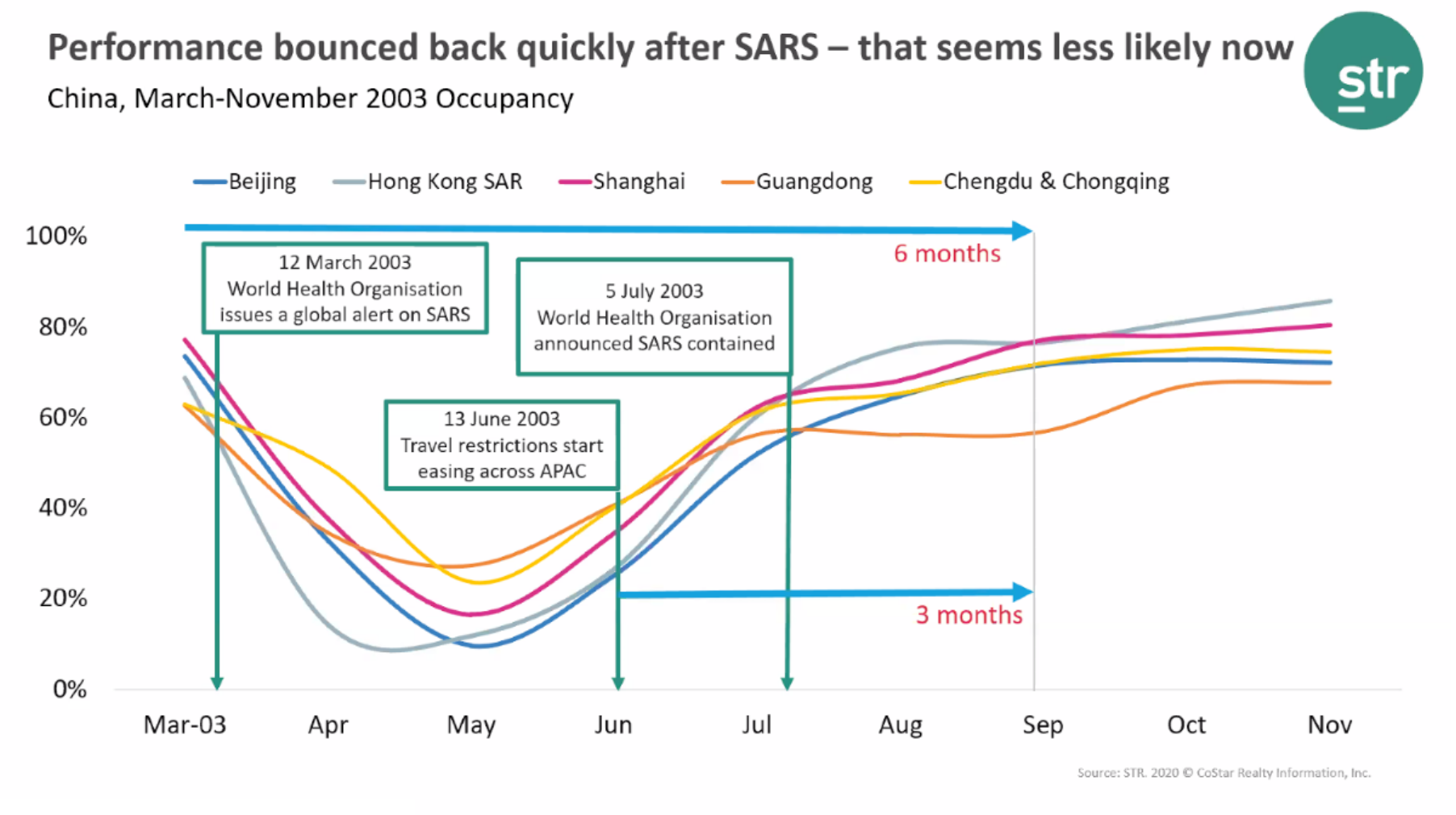

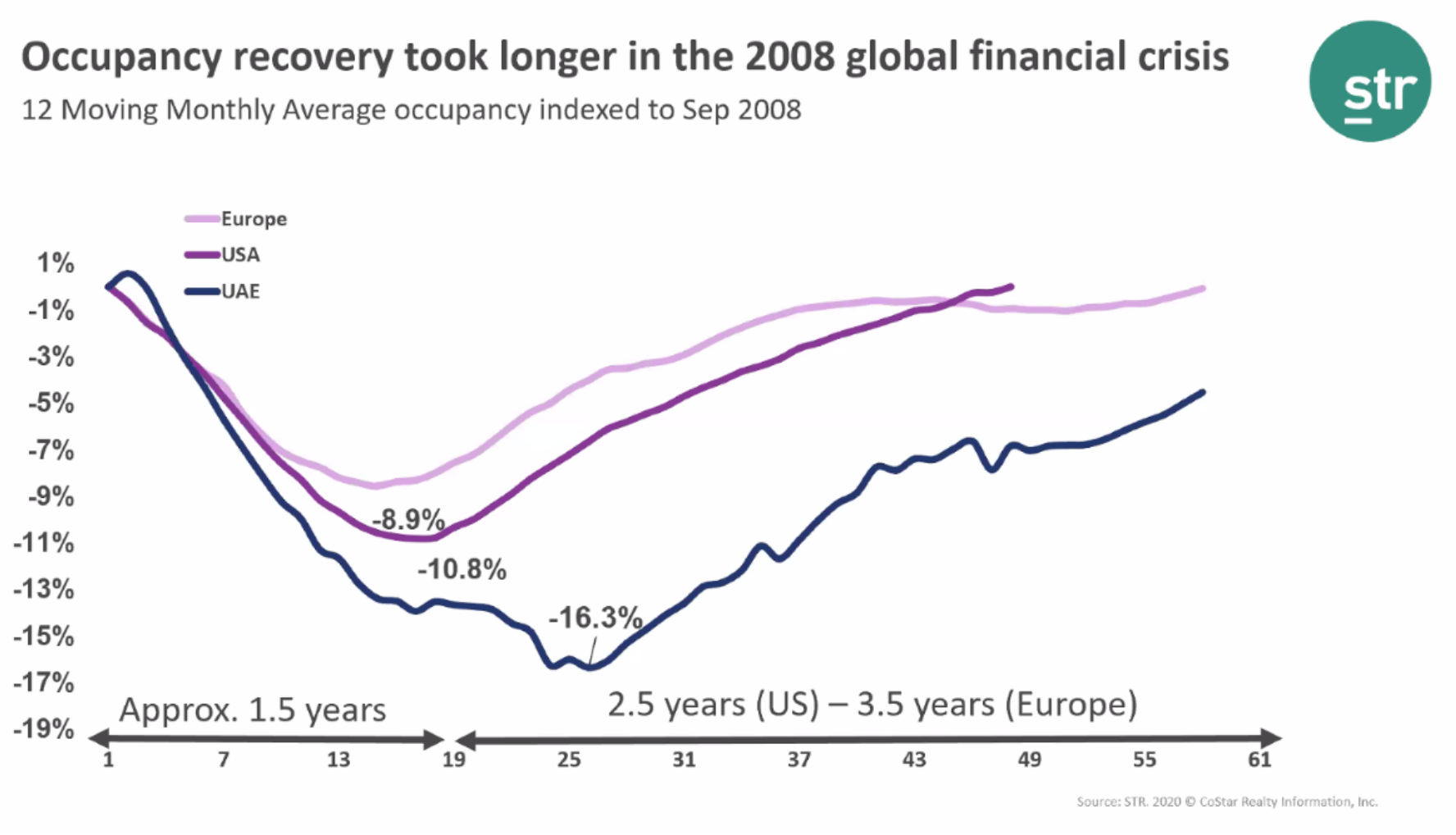

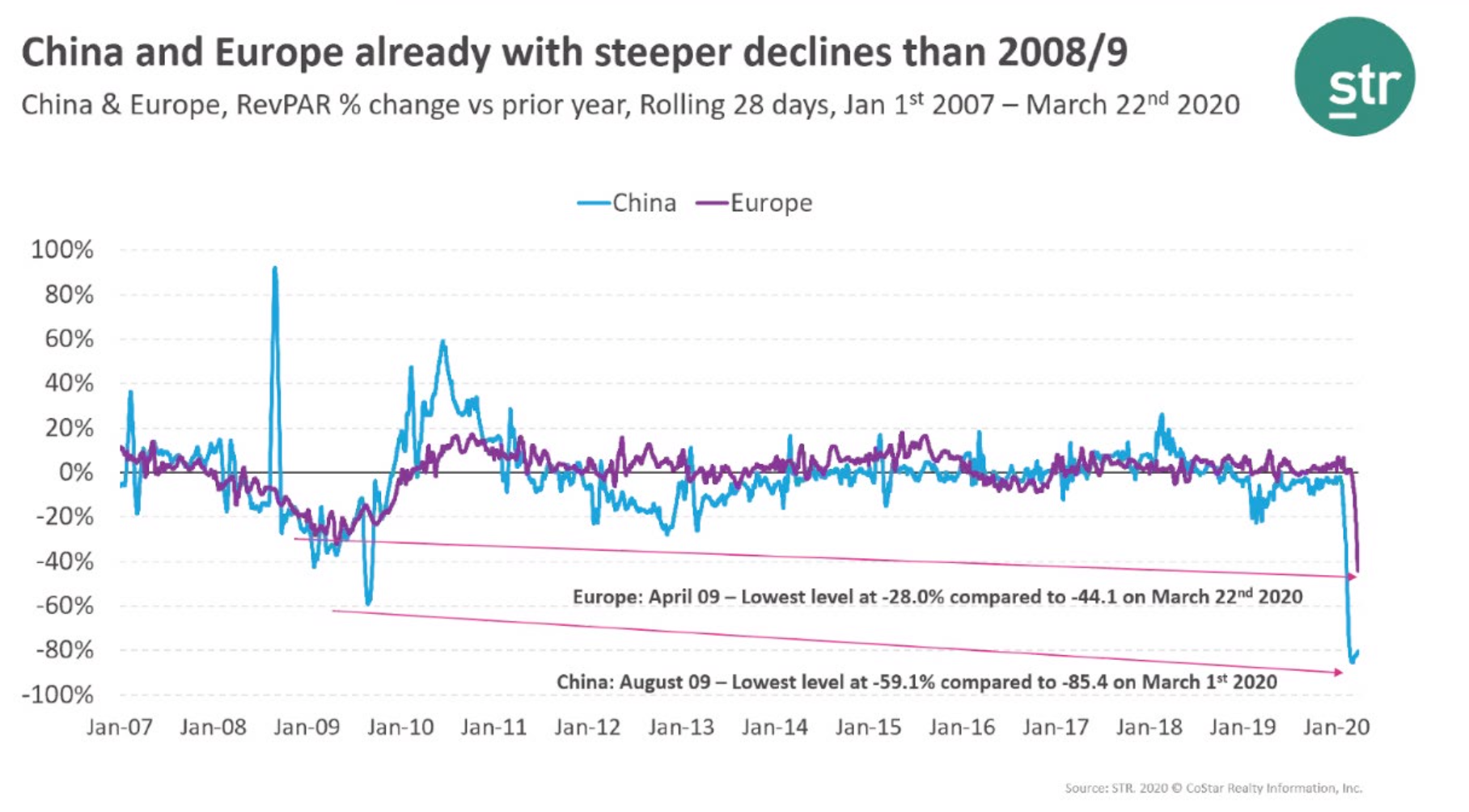

The rapid decline of this crisis is statistically much worse than 9-11 (’01), SARS (’03) and the GFC (’08). Some global cities took up to 5 years to return to pre-crisis levels after the GFC.

Now that we’ve bottomed, what will the recovery curve look like?

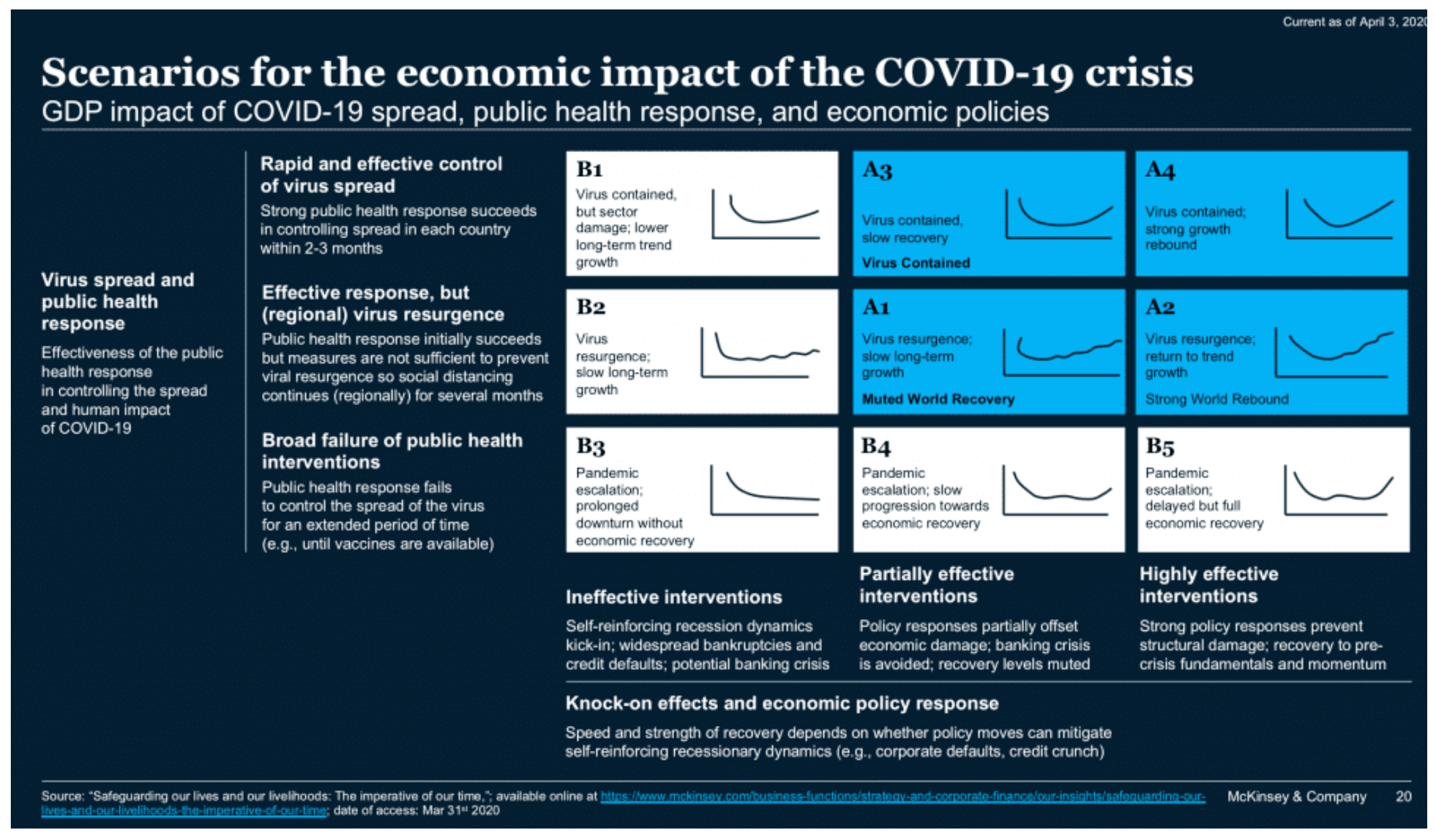

McKinsey do a good job of summarising the interplay between the virus spread, public health response and economic policies below:

Source: McKinsey & Co. ‘COVID-19: Briefing materials. Global health and crisis response’ dated April 4th 2020

I see several major factors (outside of virus spread and policy) influencing the recovery rate of hotel revPAR over the next 5 years:

1. Consumer confidence

According to the latest ANZ-Roy Morgan Consumer Confidence Rating, Australian consumer confidence is sitting just above its all-time low, of 1990. Confidence is 17% below the lowest point seen during the global financial crisis (GFC) in October 2008. The longer the economy is paused, the smaller the spend on travel will be into the future. Leisure travel is highly discretionary, and traveller loyalty to a single hotel category (luxury, mid-scale or economy) fluid.

2. Hotel pricing strategies

Hotel Occupancies will recover before Average Rates do. Studies have shown that hotels that are the fastest to drop their rates and who drop their rates the deepest can be the last ones to recover when demand comes back. Most chain operators already had a strong penchant for ‘always-on’ offers pre-crisis. Strata-managed properties preference occupancy over rate in downturns (their model has little incentive to drive higher rates), so expect them to discount aggressively and hold low for the long-term. These two operator types combined make up most of Australia’s supply, meaning there will be a smorgasbord of travel offers for at least the next two years. The only way to get your hotels revPAR back to pre-crisis levels first is to hold rate and offer value-adds.

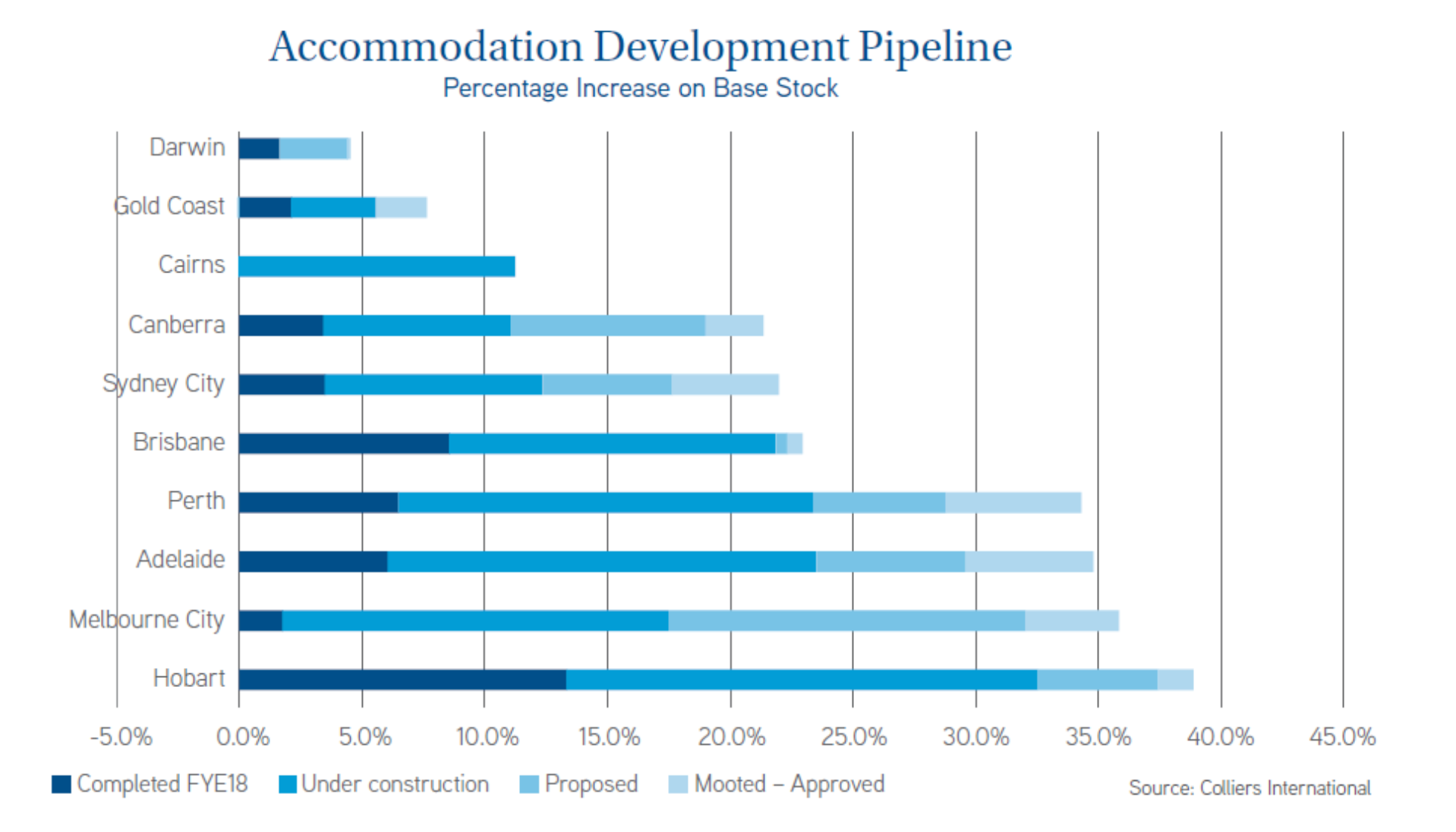

3. Hotel room supply

Shuttered hotels. The specific month that each hotel chooses to re-open will likely come down to economics. For leisure centric hotels, almost all group block business this side of February 2021 has been cancelled, postponed or will be in good time. I expect the soonest re-entry point of the leisure market to be the July school holidays, albeit at lower volume and rate levels. For SE Qld/Nth NSW properties, June is typically the lowest demand and profit month of the year so there’s merit in remaining closed for the April to June period. If the virus and travel restrictions don’t improve in the next eight weeks, the next re-entry point after the July holidays is September – meaning some hotels will remain closed until mid- September. At the time of writing, most Australian Government subsidies have been pledged for up to 6 months, which will cover most businesses to mid-September. Most other countries have much shorter windows of coverage, however, are likely to extend theirs.

Holiday-let vs. residential supply. Investor yield was previously higher on holiday letting that permanent residential for many leisure centric locations. It’s likely an unknown portion of this inventory will convert to residential during the downturn and will be slower to return to the letting pool.

Proposed hotel developments. As per the ‘Colliers Intl. Hotel Sales Analysis Report 2019’, “2020 will represent a year of significant rooms supply increases across the country. In addition to the circa 6,000 rooms added in 2019, an additional 10,000 rooms are anticipated to open across the main markets in 2020.”

Proposed or mooted developments that don’t proceed will benefit existing supply.

My current ‘best-guess’ on the recovery

My mantra: ‘prepare for the worst, expect the best’.

I believe the recovery cycle will vary ‘city by city’ and ‘hotel by hotel’ within each city. The word resilience sums it up nicely. A hotel or destinations resilience is dictated by how sustainable the underlying demand of the hotel or destination was pre-crisis, which in turn will dictate the rate of recovery. A good example of this was how the Northern NSW region was one of the last Australian regions to see hotel occupancies fall and will likely be one of the first to see them return.

For leisure centric hotels in SE Qld and Nth NSW, there will be a three or four-year recovery cycle before pre-crisis levels are seen again. If our current lockdown work behaviours become semi-permanent, some sectors such as corporate or conference travel may not come back to previous highs.

I’m willing to take a punt on what the recovery will look like for SE QLD leisure centric properties.

“revPAR will be back to pre-crisis levels in 3.5 years’ time.”

Hotels that opt to remain open in the near-term will likely trade at the below occupancies:

- April, May, June: 0-10%

- July: 15-20% (based on 50% w/end + 5-15% w/day)

- August: 20-30%

- September: 30-40%

…with a gradual improvement monthly thereafter for 3 years. In 2021, previous shoulder demand months will become low demand months, and portions of normally high demand months will become shoulder months.

There will be winners and losers! Hotel owners and operators will feel pressured to undertake product development, service innovation and to offer memorable and authentic moments – all in attempt to partially satisfy what travelling abroad used to do.

Travel preferences will shift post-crisis

I highly recommend this article from Conde Nast Traveller on travel trends post crisis. Its main points resonate strongly with me:

- Keeping it safe and simple with staycations. We’ve all been forced to stop and look around at what’s right in front of us – and, luckily for us Australia has some of the best coastline, forests and outback to explore.

- Heightened fear of flying. This will suppress long-haul flight demand for some time to come and will likely bring about a resurgence in long-haul road-trips.

- Nature and wellness. The darlings of Australia’s leisure travel industry will offer guests authentic connections to nature and wellbeing – in all of its versions.

- Convenience of serviced private villas and hotels. Avoiding mingling with strangers will be especially appealing for guests in an older age-bracket and those with health issues, all the better if they’re fully serviced and all you need can be brought to you. Shared accommodation, or hotels with perceived or true questionable hygiene practices incl. AirBnB may struggle on the other side.

- Deferred gratification. Instead of hopping on a low-cost flight for the sake of it, we’ll spend more time planning, prepping and squeezing the most out of the anticipation. Once-in-a- lifetime holidays will become exactly that again.

Airlines will need to reassess which leisure centric routes they bring back online first. It will be purely a yield-based decision. Some destinations will win, others with stronger reliance on international travellers, or only accessible via multi-sector flights will lose out. Domestic leisure offerings located within a ‘drive’ or a ‘short flight’ from the major population centres that have a a) unique brand narrative and b) have a difficult to substitute on-property experience, will benefit handsomely from Australians travellers renewed appetite to explore Australia post-crisis.

What makes a hotel or destination resilient?

Here’s my hit-list in no set order:

- Brand authority. Strong brands that attract and communicate directly to their own tribe drive a stronger proportion of direct bookings (not via 3rd parties). The stronger the amount of direct bookings a hotel had going into the crisis, the sooner it will come out of it.

- Guest satisfaction levels. The stronger the pre-crisis level, the stronger the exit will be.

- Geographical diversification. A nice mix of business from all three eastern states (a decent proportion of drive market, complimented by short-haul flights).

- Location within a town. Cities largely fill from the inside out. The same applies to beachfront locations. A hotels proximity to where ‘people want to spend most of their time’ is important.

- Diversified market segmentation. Hotels with a mixture of market segmentation generally do better than those that survive off a single traveller type. e.g. couples vs. families, intl. vs. domestic.

- Asset condition. Poor asset condition makes driving average rate very difficult. Poor asset condition equates to a longer recovery period.

- A hotels executive leadership team. Leaders with intuition and strong commercial skills will drive their hotels to pre-crisis levels faster than run-of-the-mill staff.

Disclaimer:

This Report has been prepared solely for the purposes stated herein and should not be relied upon for any other purpose. To the fullest extent permitted by law, we accept no duty of care to any third party in connection with the provision of this Report. We accept no liability of any kind to any third party and disclaim all responsibility for the consequences of any third party acting or refraining to act in reliance on the Report. We have not been required, or sought, to independently verify the accuracy of information provided to us. Accordingly, we express no opinion on the reliability, accuracy, or completeness of the information provided to us and upon which we have relied. The statements and opinions expressed herein have been made in good faith, and on the basis that all information relied upon is true and accurate in all material respects, and not misleading by reason of omission or otherwise. We reserve the right, but will be under no obligation, to review or amend this Report if any additional information, which was in existence on the date of this Report, was not brought to our attention, or subsequently comes to light.